Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Pinnacle West Capital Corporation | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Dear Fellow Shareholder:To Our Shareholders:

On behalf of our Board of Directors, management and employees, I invite you to attendparticipate in our 20152018 Annual Meeting of Shareholders.

The meeting will be held at10:30 a.m. (MST),Wednesday, May 20, 2015,16, 2018. Details regarding how to attend the meeting and the business to be conducted are in the accompanying Notice of Annual Meeting and Proxy Statement.

Pinnacle West achieved another year of outstanding performance as we continued to focus on delivering on our commitments to the customers who depend on us, the communities we serve, our dedicated team members, and the shareholders who trust us with their investment. Operational performance at our primary subsidiary, Arizona Public Service Company ("APS"), an electric utility that serves approximately 1.2 million customers throughout Arizona and operates the Heard Museum, located at 2301 N. Central Avenuelargest nuclear power plant in Phoenix, Arizona.the United States, was strong in 2017. Included in the Proxy Statement Summary you will see a number of our shareholder value creation and operational accomplishments. It is an impressive list, and one that I and the senior management team are proud to share with you. Here are just a few of those achievements:

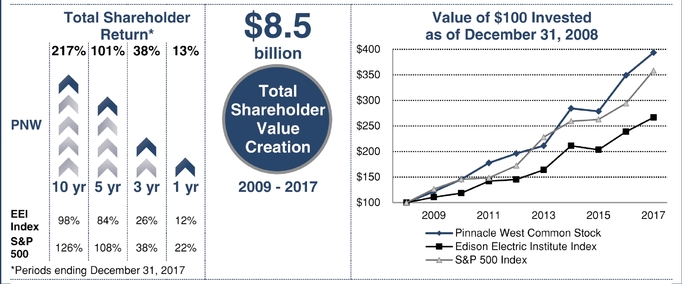

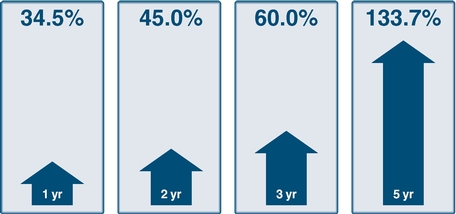

• Total shareholder value (change in market capitalization plus dividends) increased $1.1 billion in 2017, $2.8 billion over the last three years, and $5.2 billion over the last five years; • Our total shareholder return (stock price appreciation/depreciation plus dividends) ("TSR") for 2017 was 12.7% and 41.2%, 38.4%, and 100.7%, for the 2, 3, and 5-year periods, respectively; • Our share price reached a new all-time closing high, and hit new 52-week intraday-highs on 29 trading days, including a new all-time intraday high; • Pinnacle West increased its dividend for the 6th straight year, by 6% in 2017; • We continued to focus on hiring diverse candidates as well as hiring from our veteran community, and at the end of 2017 over 44% of our workforce was diverse and more than 20% of our team members were veterans; • We achieved top-quartile distribution reliability and had our best summer reliability in five years; and • We achieved a positive and collaborative outcome of our first rate review in five years, which was an important milestone for us as it allows us to continue making efficient, cost-effective investments while providing safe, reliable service for our customers. | Additional highlighted accomplishments of our Company's 2017 performance are set forth in the Proxy Statement beginning on page 2. |

In 2014,addition to delivering exceptional financial performance, we continue to focus on our sustainability efforts, fostering diversity and supporting our communities. Our usage of reclaimed water is a prime example of a sustainable balance and exemplifies our focus on managing coststhe water-energy nexus. Thanks in large part to the Palo Verde Generating Station, reclaimed water accounted for 72% of the water used in our generating facilities in 2017.

Our Executive Diversity Council worked diligently in 2017 to continue improving our workforce diversity. Over 48% of candidates hired in 2017 were ethnically or gender diverse. As a Company we are committed to diversity, respect and creatinginclusion as core to our culture and essential to our success.

In 2017 we remained steadfast in our commitment to our communities. We contributed more than $9.8 million to our Arizona communities, with more than $1.4 million invested in science, technology, engineering and mathematics ("STEM") education. Our men and women pledged more than $2.4 million through our Company-sponsored charitable giving program, through which the Company provides a 50% match. This year our team members donated nearly 110,000 volunteer hours to a diverse and wide-range of organizations, including Habitat For Humanity, Treasures for Teachers, Phoenix Children's Hospital and St. Mary's Food Bank Alliance. These are only a few examples of how our men and women continuously demonstrate a commitment to excellence by living the values core to our culture. In addition, APS continued to partner with the Arizona Diamondbacks Foundation to build youth baseball fields in deserving neighborhoods. In 2017 we built our 35th field. We are proud to support efforts that unite our communities and help them thrive.

As you know, in 2016 the Board of Directors adopted a Director Retirement Policy to provide for an orderly transition of our Board members. This year the first retirement under that policy will take place. Roy Herberger will retire from the Board effective at the Annual Meeting. Over my years at Pinnacle West, I always valued Roy's counsel, wisdom and guidance. On behalf of all of us, I extend our appreciation and thanks to Roy for his many years of contributions and dedicated service to our Company and to our shareholders.

I am both privileged and proud to lead Pinnacle West. Our men and women are working to shape a better, sustainable energy future for Arizona enabled us to meet or exceed our financial goals, thus marking another successful yearcustomers and our communities, and in that process, they are also building a more valuable company for Pinnacle West and your investment in our Company. Among these accomplishments:

At this year's Annual Meeting, we will share additional updates with you on the Company's recent performance and operations. As explained in the attached Proxy Statement, we are asking you to: (1) elect ten Board of Director nominees; (2) consider and vote for an advisory resolution to approve executive compensation; (3) ratify the appointment of our independent public accounting firm for 2015; and (4) consider a shareholder proposal, if properly presented at the meeting.

Last, but not least, your vote is important to us. Whether or not you plan to attend the Annual Meeting in person, we encourage you to vote promptly. You may vote over the Internet; by telephone; by completing, signing, dating and returning a proxy card or voting instruction form; or by voting in person at the meeting.shareholders.

Thank you for the confidence you place in Pinnacle West through your investment. We look forward to seeing you at this year's Annual Meeting.

Sincerely,

Kathryn L. Munro Lead Director |

Dear Fellow Shareholders,

On behalf of the Board, I would like to thank you for your investment in Pinnacle West. As we approach our 2018 Annual Meeting, I would like to take this opportunity to provide you with an update on how your Board is approaching and addressing key areas of shareholder interest, particularly with respect to our governance and compensation practices.

Driving Shareholder Value Creation and Promoting a Sustainable Energy Future

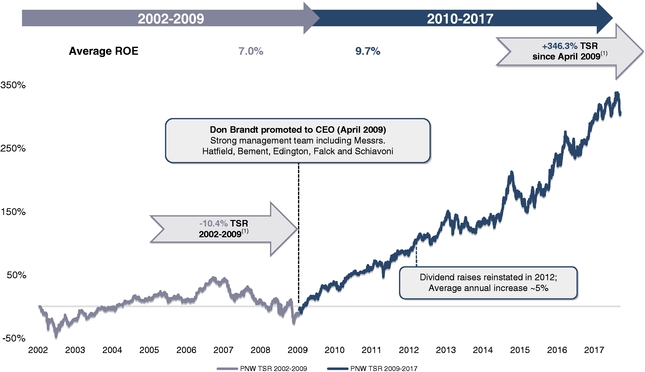

As directors of Arizona's largest and longest-serving electric company, we view operational excellence as paramount to long-term value creation for our shareholders, and our long-term strategy reflects this focus. Our management team continues to drive outstanding operational execution while growing our business and leveraging technology to promote a long-term sustainable energy future. These efforts have resulted in strong returns for our shareholders: annualized total shareholder return of 18.8% since May 1, 2009, which was when Don Brandt took over as CEO. This exceeds the annualized returns of the S&P 1500 Electric Utilities Index of 11.8% and the S&P 500 Index of 16.2%. We also continue to be recognized for our safety and sustainability leadership:

Board-Driven Shareholder Engagement

Pinnacle West has an established shareholder engagement program, which was further augmented during 2017 in response to what the Board considered a disappointing level of shareholder support for our annual advisory vote on compensation. Shareholder input is very valuable to the Board's decision-making, and we wanted to ensure we had the opportunity to engage directly with our shareholders on our compensation, governance and broader Board practices. As Lead Director and member of the Human Resources Committee, I participated on behalf of the independent directors in a number of the shareholder discussions during the fall of 2017. These conversations were valuable to our Board, spurred important discussions, and have resulted in changes and disclosure enhancements that you will see detailed in this Proxy Statement.

Shareholder-Informed Compensation Program Changes

As a Board, we are committed to an executive compensation program that establishes strong pay for performance alignment and supports our ability to attract and retain a talented and proven leadership team. We seek to design compensation programs that support our long-term goals, reward achievement of long-term performance and align with the interests and feedback of our shareholders. To this end, our compensation programs have evolved with our business,

including several changes made in 2016. Following shareholder discussions in 2017, we have made further changes to our program that we believe will create even greater alignment between our executives and the performance of our Company, and changes to our program and disclosures that reflect the feedback we have received from our shareholders. These changes are detailed in the Compensation Discussion and Analysis of this Proxy Statement and include:

These structural and disclosure enhancements are directly in response to feedback we received from our shareholders.

Thoughtful and Systematic Management Succession Planning Process

As you would expect for a company with a highly skilled and long-tenured management team, the Board is very engaged in succession planning to ensure we are building a sustainable leadership pipeline. CEO and senior leadership succession planning continues to be a focus for the Board, and we have been executing on a very deliberate succession and development plan. Our current management team, under the leadership of Don Brandt, has delivered very strong performance and the Board and its Committees are actively involved in our succession plans for our top talent to ensure we are providing development opportunities that will allow for smooth leadership transitions in the future.

Robust Board Refreshment and Succession Planning Practices

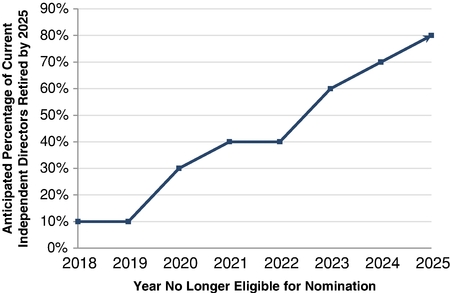

The Board has established strong practices to support regular Board evaluation and refreshment. In 2016, the Board adopted a Director Retirement Policy to facilitate an orderly transition of Board members and implemented a five-year plan to refresh the Board and its leadership. This five-year plan encompasses the following:

This process helps guide the Board in its recruitment efforts.

On behalf of the Board, I want to thank our shareholders for their time and feedback. I am pleased to provide this additional window into the Board's activities in 2017 and express our commitment to running our business for the long-term value creation for our shareholders. We appreciate your support at our 2018 Annual Meeting.

Sincerely,

![]()

| Notice of the Annual Meeting of Shareholders |

April 2, 2015March 29, 2018

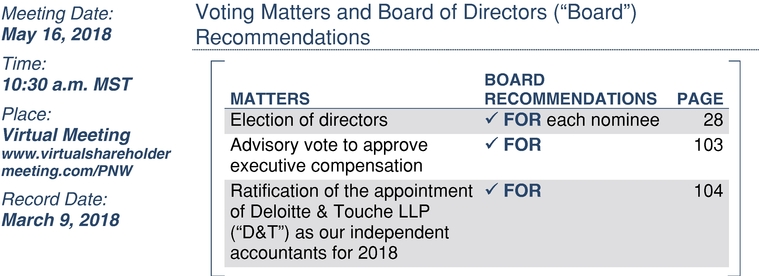

The 20152018 Annual Meeting of Shareholders (the "Annual Meeting") of Pinnacle West Capital Corporation ("Pinnacle West", "PNW", or the "Company") will be held at the Heard Museum, 2301 North Central Avenue, Phoenix, Arizona 85004, at 10:30 a.m., Mountain Standard Time, on Wednesday, May 20, 2015.16, 2018. The Annual Meeting may be accessed online at www.virtualshareholdermeeting.com/PNW. The purposes of the Annual Meeting are:

All shareholders of record at the close of business on March 12, 20159, 2018 are entitled to notice of and to vote at the Annual Meeting. Your vote is important. Whether or not you plan to attendparticipate in the Annual Meeting in person,or not, please promptly vote by telephone, over the Internet, by proxy card, or by voting instruction form.

By order of the Board of Directors,

| ||

DIANE WOOD

Corporate Secretary

Executive Offices Address:

PINNACLE WEST CAPITAL CORPORATION

Post Office Box 53999

Phoenix, Arizona 85072-3999

Table of Contents |

2018 Proxy Statement |![]() i

i

| ii |

This summary highlights certain information contained elsewhere in this Proxy Statement. As it is only a summary, please read the complete Proxy Statement and 20142017 Annual Report before you vote. The Proxy Statement and form of proxy are first being made available to shareholders on or about March 29, 2018.

Who We Are |

Strategic Framework

TheCore For example, employees are an element of our Core and one of our greatest assets. The Core helps us focus on keeping them safe, fostering a healthy and balanced environment, supporting their development through training and mentoring and encouraging engagement. This culture not only benefits each individual employee, it also positions our Company for long-term sustainable success. |  |

2018 Proxy Statement |![]() 1

1

| ||

| ||

| ||

| ||

|

Strategic Priorities

TheCore continues to serve as the foundation for all strategic and business initiatives. In turn, our performance metrics reinforce our highest priorities, including operational excellence, financial strength and leveraging economic growth, in a tangible, measurable way, and allow us to monitor and enhance our progress.

Building on that foundation, the APS Strategic Business Plan is anchored by four themes that align with industry trends shaping our future and the way we do business:

|

Shareholder Value

Our management team has delivered superior performance:

Financial and Operating Highlights

| | ||

| ü | PNWincreased its dividend for the 6th consecutive year, by 6%; | |

| ü | Maintainedstrong credit ratings from all three rating agencies; | |

| ü | APS spent$363 million with diverse suppliers; | |

| ü | APS continued successful operation of the Palo Verde Generating Station, a nuclear energy facility that is the largestclean-air generator in the United States; and | |

| ü | Achievedtop quartile distribution reliability metrics for 2017, and had the best summer reliability in 5 years. | |

| | ||

2![]() | 2018 Proxy Statement

| 2018 Proxy Statement

| Proxy Statement Summary |

Achievements

| | ||

| ü | Received theDistributech Renewable Integration Project of the Year award for the Solar Partner Program; | |

| ü | Obtained "Leadership" rating from CDP for climate change and water management – one of only two U.S. utilities that earned the highest rating in both categories; | |

| ü | Recognized as theCorporate Advocate of the Year by the National Center for American Indian Enterprise Development; and | |

| ü | Recognized as aBest Corporation for Veteran's Business Enterprises by the National Veteran-Owned Business Association. | |

| | ||

Community Engagement

| | ||

| ü | Contributed more than$9.8 million to our Arizona communities, with more than $1.4 million invested in STEM education; | |

| ü | Employees pledged more than$2.4 million through our Company-sponsored charitable giving program, through which the Company provides a 50% match; | |

| ü | Built our 35th baseball field in one of our Arizona neighborhoods together with the Arizona Diamondbacks Foundation; and | |

| ü | Employees donated nearly110,000 volunteer hours to community organizations. | |

| | ||

Sustainability

Our commitment to create a sustainable future for our Company and our customers will continue to light our way to success — not just today but for years to come. We continue to make progress on ourfive critical areas of sustainability:

| | ||||

| Carbon Management | • 50% of our diverse energy mix iscarbon-free • Plan toreduce carbon intensity by 23% over the next 15 years • MSCI Environmental Sustainability and GovernanceA rating (as of 10/27/17) | |||

| | Energy Innovation | • More than 1,300 MW of installed solar capacity • Plan to add over500 MW of energy storage in the next 15 years | ||

| | Safety & Security | • 70% reduction in Occupational Safety and Health Administration ("OSHA") recordable injuries over the past 10 years • Remain top decile for safety performance in the U.S. electric utilities industry | ||

| | Water Resources | • 14% reduction in groundwater use since 2014 • 20 billion gallons of water recycled each year to cool Palo Verde Generating Station | ||

| | People | • Averageemployee tenure of 13 years due to strong talent strategy • More than 20% of our employees areveterans • Palo Verde hosted a nuclearWomen in Leadership forum | ||

| | ||||

To learn more about our sustainability efforts, please see our Corporate Responsibility Report located on our website (www.pinnaclewest.com).

2018 Proxy Statement | �� ![]() 3

3

Proxy Statement Summary |

Governance Practices |

Our Board remains committed to maintaining strong corporate governance practices. Our practices include:

| | ||

| ü | Adirector retirement policy at age 75; | |

| ü | Proxy access rights allowing up to 20 shareholders owning 3% of our outstanding stock for at least 3 years to nominate up to 25% of the Board; | |

| ü | Strong ongoing shareholder engagement program that expanded in 2017, including participation of the Lead Director in several shareholder meetings; | |

| ü | Independent Lead Director role with clearly defined and robust responsibilities; | |

| ü | Ten of our eleven current directors are independent and the members of all of the Board Committees are independent; | |

| ü | Annual elections of all directors (see page 5 of this Proxy Statement Summary for a list of the nominees); | |

| ü | Robust board and management succession planning; | |

| ü | No poison pill plan or similar anti-takeover provision in place; | |

| ü | No supermajority provisions in our Articles of Incorporation or Bylaws; | |

| ü | Each of our directorsattended at least 90% of the Board meetings and any Board committee meeting on which he or she served; and | |

| ü | Our directors and officers are prohibited from pledging or hedging our stock. | |

| | ||

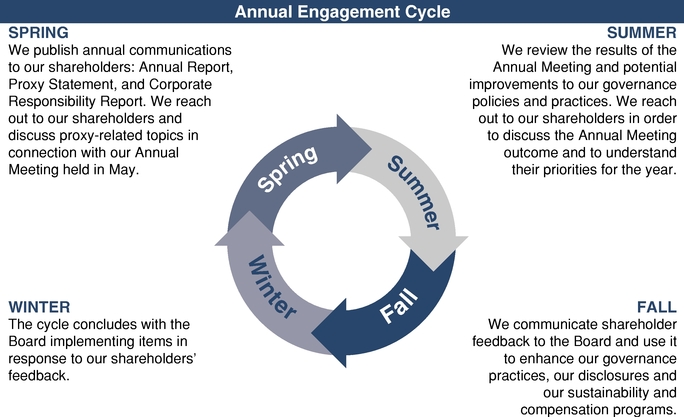

Shareholder Engagement |

We have an established shareholder engagement program to maintain a dialogue with our shareholders throughout the year, which was further augmented during 2017 in response to what our Board considered a disappointing level of shareholder support for our annual advisory vote on compensation. Each year we strive to respond to shareholder questions in a timely manner, conduct extensive proactive outreach to investors, and evaluate the information we provide to investors in an effort to continuously improve our engagement. In 2017, we contacted the holders of approximately 50% of the shares outstanding and met with the holders of approximately 40% of the shares outstanding. Our Lead Director and member of the Human Resources Committee, Kathryn Munro, participated in a number of the shareholder discussions providing shareholders with direct access to the Board.

What our shareholders think is important to us and we want to ensure we have the opportunity to engage directly with our shareholders. We seek to maintain a transparent and productive dialogue with our shareholders by:

A detailed discussion of this outreach and the Board's response can be found on pages 23-24 and 48-49 of this Proxy Statement.

4![]() | 2018 Proxy Statement

| 2018 Proxy Statement

| Proxy Statement Summary |

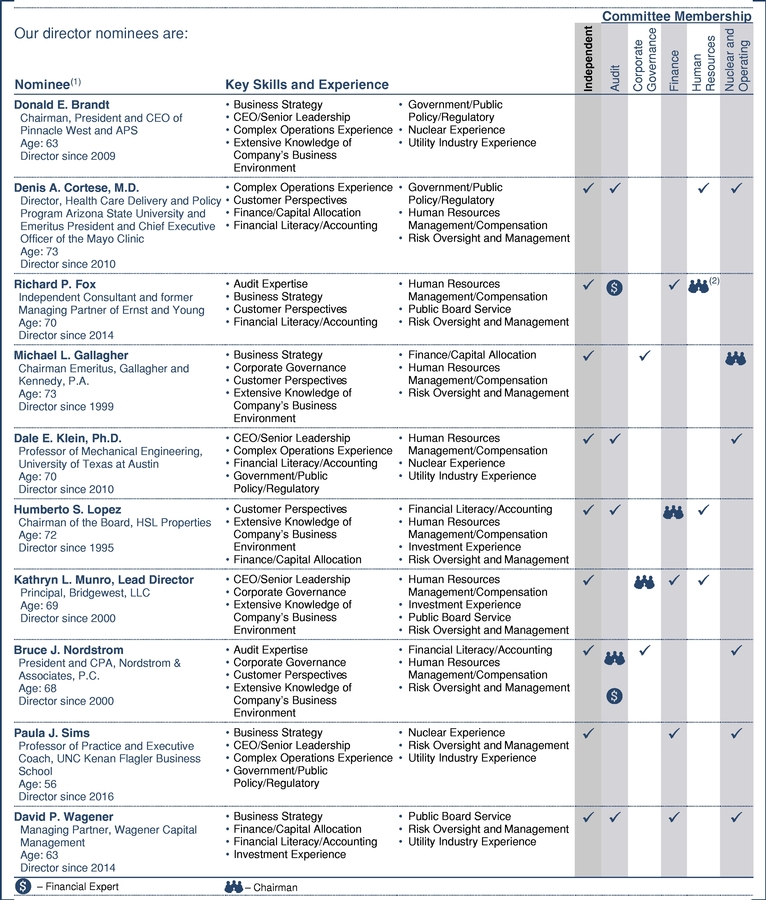

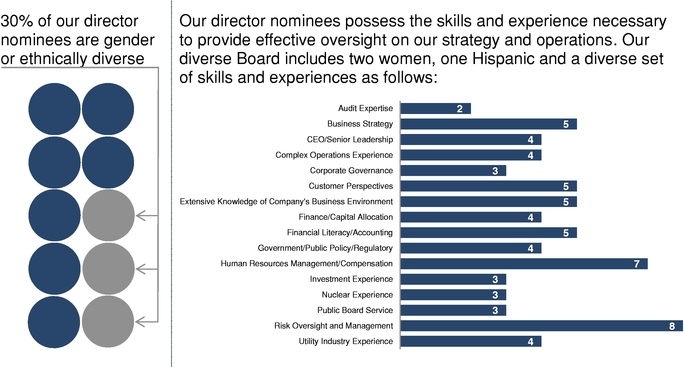

Director Nominees, Their Skills and Experience |

2018 Proxy Statement |![]() 5

5

Proxy Statement Summary |

| | | | ||

| ||||

Succession Planning |

| ||||

Given our need for specialized experience, we also maintain strong management succession planning practices and are focused on developing and retaining talent within our Company. Our Board's focus on attracting, developing and retaining highly skilled and experienced executives is a core consideration in structuring our executive compensation programs. 6 |

|

Our director nominees are:

| | | DIRECTOR SINCE | | COMMITTEE MEMBERSHIPS | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NAME | AGE | INDEPENDENT | AC | CGC | FC | HRC | NOC | |||||||||

| | | | | | | | | | | | | | | | | |

Donald E. Brandt | 60 | 2009 | No — Company President and CEO | | | | | | ||||||||

Denis A. Cortese, M.D. | 70 | 2010 | Yes | · | · | · | ||||||||||

Richard P. Fox | 67 | 2014 | Yes | · | | · | · | | ||||||||

Michael L. Gallagher | 70 | 1999 | Yes | · | ||||||||||||

Roy A. Herberger, Jr., Ph.D. | 72 | 1992 | Yes | | · | · | | |||||||||

Dale E. Klein, Ph.D. | 67 | 2010 | Yes | · | · | |||||||||||

Humberto S. Lopez | 69 | 1995 | Yes | · | | · | | |||||||||

Kathryn L. Munro* | 66 | 2000 | Yes | · | · | |||||||||||

Bruce J. Nordstrom | 65 | 2000 | Yes | · | | | · | |||||||||

David P. Wagener | 60 | 2014 | Yes | · | · | · | ||||||||||

|

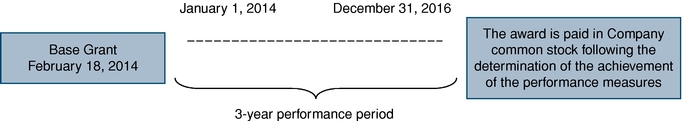

Total compensation, as reported in the Summary Compensation Table and calculated in accordance with the rules of the Securities and Exchange Commission (the "SEC"), is set forth below for Messrs. Brandt, Hatfield, Edington, Falck, and Schiavoni (the "Named Executive Officers"). The total compensation number includes a year-over-year change in pension value as determined under the SEC rules. The change in pension value is subject to many variables that are not related to Company or individual performance, such as interest rates. As such, we do not believe this number is helpful in evaluating executive compensation. We also note that the SEC rules require us to include in the stock award column the grant date fair value of equity grants given to our Named Executive Officers in 2014, even though the performance shares will not vest, if at all, until the end of a three-year performance period and then only to the extent the specified performance conditions are met, and the restricted stock units ("RSUs") will vest in installments each year through 2018.

| NAME AND PRINCIPAL POSITION | SALARY ($) | BONUS ($) | STOCK AWARDS ($) | NON-EQUITY INCENTIVE PLAN COMPENSATION ($) | CHANGE IN PENSION VALUE AND NONQUALIFIED DEFERRED COMPENSATION EARNINGS ($) | ALL OTHER COMPENSATION ($) | TOTAL ($) | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | | | | | | | |

Donald E. Brandt, | | 1,240,000 | | 0 | | 4,199,976 | | 1,852,560 | | 2,009,011 | | 26,729 | | 9,328,276 | ||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

James R. Hatfield, | 570,000 | 0 | 750,320 | 502,603 | 465,143 | 24,050 | 2,312,116 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Randall K. Edington, | | 960,511 | | 0 | | 500,031 | | 1,050,775 | | 2,130,198 | | 1,072,586 | | 5,714,101 | ||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

David P. Falck, | 522,000 | 0 | 750,320 | 423,697 | 419,745 | 278,991 | 2,394,753 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Mark A. Schiavoni, | | 563,958 | | 0 | | 750,320 | | 558,031 | | 424,749 | | 27,419 | | 2,324,477 | ||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

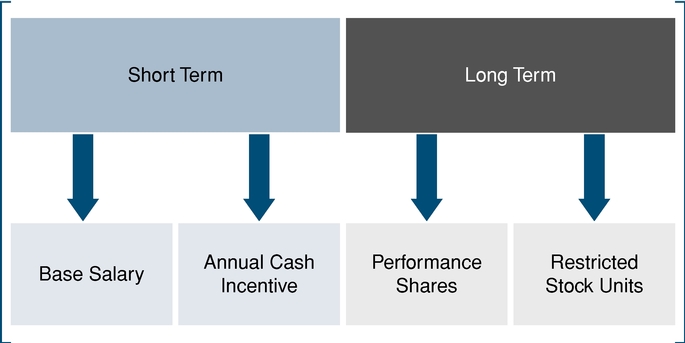

Executive Compensation Program Highlights |

Highlights of our executiveOur compensation program include:

Our incentive program structure and metrics are

| | | | | | | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | |

| | Pay Element | | | Period | | Performance Link | | |||||||||

| | | | | | | | | | | | | | | | | |

| | Base Salary | | | Cash | | | | | | |||||||

| | | | | | | | | | | | | | | | | |

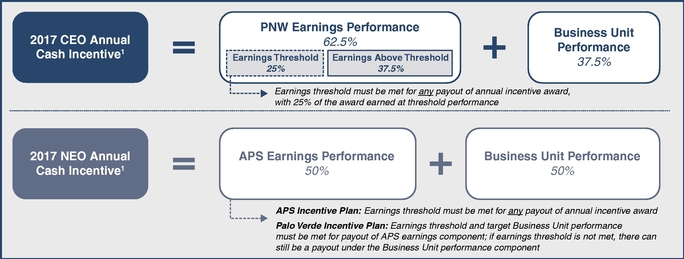

| | Annual | | | Cash | | | 1 year | | | Earnings CEO: 62.5% NEOs(1): 50.0% | | |||||

| | | | | | | | | | | | | | | | | |

| | Incentives | | | | | | | Business Unit Performance CEO: 37.5% NEOs(1): 50.0% | | |||||||

| | | | | | | | | | | | | | | | | |

| | | | | Performance | | | | | Relative TSR 50% | | ||||||

| | | | | | | | | | | | | | | | | |

| | Long-Term Incentives | | | Shares 60%(2) | | | 3 years | | | Relative Operational Performance 50% | | |||||

| | | | | | | | | | | | | | | | | |

| | | | | Restricted Stock Units 40%(2) | | | Vest ratably over 4 years | | | Stock Price | | |||||

| | | | | | | | | | | | | | | | | |

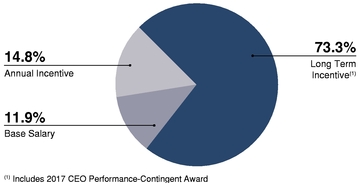

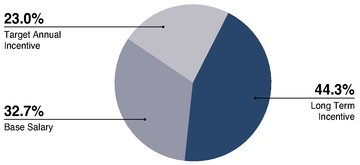

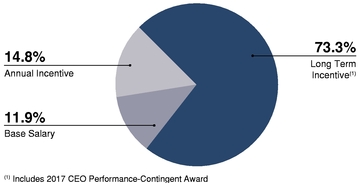

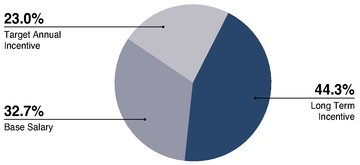

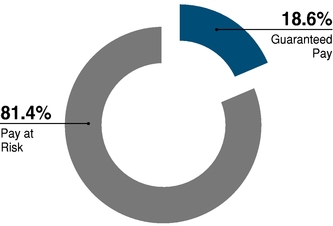

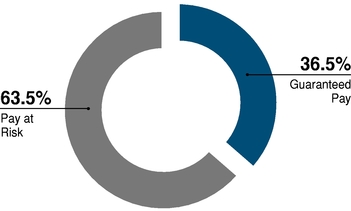

| 2017 CEO Total Compensation 88% at risk | | 2017 Average for Other NEOs' Total Compensation 67% at risk |

|---|---|---|

| |  |

2018 Proxy Statement |![]() 7

7

In 2014, we delivered strong financial results and operational performance. Our results included:

We are asking our shareholders to ratify the appointment of D&T as our independent accountants for 2015. A summary of fees paid to D&T in 2013 and 2014 is set forth on page 82.

Shareholder proposals submitted for inclusion in our 2016 Proxy Statement must be received by us no later than December 3, 2015. Notice of shareholder proposals to be raised from the floor of the 2016 Annual Meeting of Shareholders must be received by us no earlier than January 20, 2016 and no later than February 19, 2016.

Highlights of our corporate governance include:

The Company's 20152018 Annual Meeting of Shareholders ("Annual Meeting") will be held at the Heard Museum, 2301 North Central Avenue, Phoenix, Arizona 85004, at 10:30 a.m., Mountain Standard Time, on Wednesday, May 20, 2015.16, 2018. The Annual Meeting will not be held at a physical location, but will instead be held virtually, where shareholders will participate by accessing a website using the Internet. The Annual Meeting will be accessed atwww.virtualshareholdermeeting.com/PNW. To participate in the Annual Meeting, you will need the 16-digit control number included on the proxy card, the Internet Notice or the voting instruction form. Online check-in will begin at 10:15 a.m. Mountain Standard Time, and you should allow ample time for the online check-in proceedings. We will have technicians standing by ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call: 855-449-0991. An audio broadcast of the Annual Meeting will be available by telephone toll-free at 877-328-2502 (domestic) or 412-317-5419 (international). Upon dialing in, you will need to provide your 16-digit control number.

We continue to believe that the virtual-only format, which we used for the first time last year, is in the best interests of our shareholders, given the time and expense of an in-person meeting compared to the shareholder participation at those meetings. The number of non-employee shareholders actually attending our Annual Meetings of Shareholders has significantly dwindled. For the past five in-person meetings, only about 30 shareholders attended each of the meetings. The meetings, on average, lasted less than 45 minutes, including the formal business portion of the meeting, the remarks by the CEO, a video highlighting the Company's performance, and the question and answer period. A virtual meeting allows all of our shareholders, regardless of location, the ability to participate in the Annual Meeting.

Our virtual meeting will be governed by our Rules of Conduct, which we use for both in-person and virtual meetings. Shareholders at the virtual-only meeting will have the same rights as at an in-person meeting, including the rights to vote and ask questions through the virtual meeting platform.

Unless you elected to receive printed copies of the proxy materials in prior years, you will receive a Notice of Internet Availability of Proxy Materials by mail, or if you so elected, by electronic mail (the "Internet Notice"). The Internet Notice will tell you how to access and review the proxy materials. If you received an Internet Notice by mail and would like to receive a printed copy of the proxy materials, you should follow the instructions included on the Internet Notice.

The Internet Notice is first being sent to shareholders on or about April 2, 2015.March 29, 2018. The Proxy Statement and the form of proxy relating to the Annual Meeting are first being made available to shareholders on or about April 2, 2015.March 29, 2018.

8![]() | 2018 Proxy Statement

| 2018 Proxy Statement

| Proxy Statement — General Information |

All shareholders at the close of business on March 12, 20159, 2018 (the "record date""Record Date") are entitled to vote at the meeting. Each holder of outstanding Company common stock is entitled to one vote per share held as of the record date on all matters on which shareholders are entitled to vote, except for the election of directors, in which case "cumulative" voting applies (see "Vote Required — Election of directors"). At the close of business on the record date,Record Date, there were 110,746,055111,928,566 shares of common stock outstanding.

| Vote prior to the Annual Meeting by Internet. The website address for Internet voting is on the proxy card, the Internet | ||

Vote prior to the Annual Meeting by telephone. The toll-free number for telephone voting is on | ||

Vote prior to the Annual Meeting by scanning the QR code. The QR code is on the proxy card, the Internet Notice and the voting instruction form, and is available 24 hours a day. | ||

Vote prior to the Annual Meeting by mail. You may vote by mail by promptly marking, signing, dating, and mailing your proxy card or voting instruction form (a postage-paid envelope is provided for mailing in the United States). | ||

Vote |

If you vote by telephone or Internet, DO NOT mail a proxy card.

You may change or revoke your vote at any time beforeby: re-voting by telephone; re-voting by Internet; or re-voting during the formal business portion of the Annual Meeting. For shares held in your name you may change your vote by re-submitting a signed proxy is exercised by:card. In addition, for shares held in your name, you may also revoke a previously submitted proxy card by filing with our Corporate Secretary either a written notice of revocation orrevocation. For shares for which you are the beneficial owner but not the shareholder of record, you may change your vote by re-submitting a signed proxy card bearing a later date; re-voting by telephone; or re-voting by Internet. Your proxy will be suspended with respectvoting instruction form to your broker. In addition, for shares for which you are the beneficial owner but not the shareholder of record, you should contact your broker if you attend the meeting in person and so request, although attendance at the meeting will not by itselfwould like to revoke a previously-granted proxy.your vote.

Your vote is confidential. Only the following persons have access to your vote: election inspectors; individuals who help with the processing and counting of votes; and persons who

2018 Proxy Statement |![]() 9

9

Proxy Statement — General Information |

need access for legal reasons. All votes will be counted by an independent inspector of elections appointed for the Annual Meeting.

The presence, in person or by proxy, of a majority of the outstanding shares of our common stock is necessary to constitute a quorum at the Annual Meeting. In counting the votes to determine whether a quorum exists, shares that are entitled to vote but are not voted at the direction of the beneficial owner (called abstentions) and votes withheld by brokers in the absence of instructions from beneficial owners (called broker non-votes) will be counted for purposes of determining whether there is a quorum. Shares owned by the Company are not considered outstanding or present at the meeting.

Election of directorsdirectors.. Individuals receiving the highest number of votes will be elected. The number of votes that a shareholder may, but is not required to, cast is calculated by multiplying the number of shares of common stock owned by the shareholder, as of the record date,Record Date, by the number of directors to be elected. Any shareholder may cumulate his or her votes by casting them for any one nominee or by distributing them among two or more nominees. Abstentions will not be counted toward a nominee's total and will have no effect on the election of directors. You may not cumulate your votes against a nominee. If you hold shares in your own name and would like to exercise your cumulative voting rights, you must do so by mail. If you hold shares beneficially through a broker, trustee or other nominee and wish to cumulate votes, you should contact your broker, trustee or nominee. If you would like to exercise your cumulativefollow the instructions on the voting rights, you must do so by mail. The Company's Bylaws provide that, in an uncontested election, a director nominee who receives a greater number of votes cast "withheld" for his or her election than "for" such election will promptly tender his or her resignation to the Corporate Governance Committee. The Corporate Governance Committee is required to evaluate the resignation, taking into account the best interests of the Company and its shareholders, and will recommend to the Board whether to accept or reject the resignation.instruction form.

Under the current rules of the New York Stock Exchange ("NYSE"), your broker is not able to vote on your behalf in any director election unless you give your broker specific voting instructions. We encourage you to provide instructions so that your shares will be counted in the election of directors.

Say-on-Pay vote.. The votes cast "for" must exceed the votes cast "against" to approve the advisory resolution on the compensation disclosed in this Proxy Statement of our Named Executive OfficersNEOs identified on page 44 — the Say-on-Paysay-on-pay vote. This resolution is not intended to address any specific item of compensation, but rather the overall compensation of the Named Executive OfficersNEOs and the

compensation philosophy, policies and procedures described in this Proxy Statement. Because your vote is advisory, it will not be binding on the Board or the Company. However, theThe Board will review the voting results and take them into consideration when making future decisions regarding executive compensation. Abstentions and broker non-votes will have no effect on the outcome of this proposal. We will hold an advisory vote on Say-on-Paysay-on-pay on an annual basis until we next hold an advisory vote of shareholders on the frequency of such votes as required by law.

Ratification of the appointment of the independent accountants and approval of the shareholder proposalaccountants.. The votes cast "for" must exceed the votes cast "against" to ratify the appointment of the independent accountants for the year ending December 31, 2015 and for the approval of the shareholder proposal.2018. Abstentions and broker non-votes will have no effect on the outcome of these proposals.this proposal.

Board Recommendations |

The Board recommends a vote:

10![]() |

|

2018 Proxy Statement

| Proxy Statement — General Information |

XAGAINST the approval of the shareholder proposal (Proposal 4).

The Board is not aware of any other matters that will be brought before the shareholders for a vote. If any other matters properly come before the meeting, the proxy holders will vote on those matters in accordance with the recommendations of the Board or, if no recommendations are given, in accordance with their own judgment.

In order to attend the Annual Meeting, you will need to present a valid picture identification, such as a driver's license or passport, and either:

Please do not carry items such as large handbags and packages to the meeting, as we reserve the right to inspect any items brought into the meeting. Weapons are prohibited in the meeting. We also reserve the right to prohibit bringing cell phones, pagers, cameras, recording devices, and other items into the meeting room.

If you and one or more shareholders share the same address, it is possible that only one Internet Notice, Annual Report or Proxy Statement was delivered to your address. Registered

shareholders at the same address who wish to receive separate copies of the Internet Notice, the Annual Report or Proxy Statement may:

The Company will promptly deliver to you the information requested. Registered shareholders who share the same address but wish to receive one Internet Notice, Annual Report or Proxy Statement may contact the Company through the same methods listed above. Shareholders who own Company stock through a broker and who wish to receive single or separate copies of the Internet Notice, Annual Report or Proxy Statement should contact their broker.

You may access our Annual Report and Proxy Statement via the Internet. Copies of the Annual Report and Proxy Statement are available on the Company's website (www.pinnaclewest.com) and will be provided to any shareholder promptly upon request. Shareholders may request copies from Shareholder Services at the telephone number or addresses set forth above, or as described on the Internet Notice.

Shareholder Proposals.To be included in the proxy materials for the 20162019 Annual Meeting of Shareholders (the "2016"2019 Annual Meeting"), any shareholder proposal intended to be presented at that meeting must be received by our Corporate Secretary no later than December 3, 2015November 29, 2018 at the following address:

Corporate Secretary

Pinnacle West Capital Corporation

400 North Fifth Street, Mail Station 8602

Phoenix, Arizona 85004

A shareholder who intends to present a proposal at the 20162019 Annual Meeting, but does not wish it to be included in the 20162019 proxy materials, must submit the proposal no earlier than January 20, 201616, 2019 and no later than the close of business on February 19, 2016. Nominations15, 2019.

2018 Proxy Statement |![]() 11

11

Proxy Statement — General Information |

Shareholder Nominations. Shareholder nominations for a director to the Board must be received by the Corporate Secretary at the address set forth above by November 19, 2015. 16, 2018 ("Shareholder Nomination").

Proxy Access. In February 2017, our Board amended the Bylaws to provide, among other things, that under certain circumstances a shareholder or group of shareholders may include director candidates that they have nominated in our annual meeting proxy statement — "proxy access." Under these provisions, a shareholder or group of up to 20 shareholders seeking to include director nominees in our annual meeting proxy statement must own 3% or more of our outstanding common stock continuously for at least the previous three years. Generally the number of qualifying shareholder-nominated candidates the Company will include in its annual meeting proxy materials will be limited to the greater of 25% of the Board or two candidates. Based on the current Board size of 11 directors, the maximum number of proxy access candidates we would be required to include in our proxy materials is two.

Nominees submitted under the proxy access provisions that are later withdrawn or are included in the proxy materials as Board-nominated candidates will be counted in determining whether the 25% maximum has been reached. If the number of shareholder-nominated candidates exceeds 25%, each nominating shareholder or group of shareholders may select one nominee for inclusion in our proxy materials until the maximum number is met. The order of selection would be determined by the amount (largest to smallest) of shares of our common stock held by each nominating shareholder or group of shareholders. Requests to include shareholder-nominated candidates under proxy access must be received by our Corporate Secretary at the address set forth above not earlier than the close of business on October 30, 2018 nor later than the close of business on November 29, 2018. The number of qualifying shareholder-nominated candidates the Company will include in its proxy materials under proxy access will be reduced on a one-for-one basis in the event the Company receives a Shareholder Nomination, but at least one qualifying shareholder-nominated proxy access nominee will be included in the proxy materials.

In all cases, shareholders and nominees must also comply with the applicable rules of the SECSecurities and Exchange Commission ("SEC") and the applicable sections of our Bylaws.Bylaws relating to qualifications of nominees and nominating shareholders and disclosure requirements.

The Board is soliciting the enclosed proxy. The Company may solicit shareholders over the Internet, by telephone or by mail. The Company has retained D.F. King & Co., Inc. to assist in the distribution of proxy solicitation materials and the solicitation of proxies for $10,000,$11,000, plus customary expenses. The costs of the solicitation will be paid by the Company. Proxies may also be solicited in person, by telephone or electronically by Company personnel who will not receive additional compensation for such solicitation. As required, the Company will reimburse brokerage houses and others for their out-of-pocket expenses in forwarding documents to beneficial owners of our stock.

| 12 |

Board Meetings and Attendance |

| In 2017 each of our directors attended 90% of the Board meetings and any meetings of Board committees on which he or she served. | In 2017, our Board held seven meetings and each of our directors attended 90% of the Board meetings and any meetings of Board committees on which he or she served. Each director is expected to participate in the Annual Meeting. All Board members attended the 2017 Annual Meeting. |

Board Committees |

The Board has the following standing committees: Audit; Corporate Governance; Finance; Human Resources; and Nuclear and Operating. All of the charters of the Board's committees are publicly available on the Company's website (www.pinnaclewest.com). All of our committees conduct a formal review of their charters every other year and as often as any committee member deems necessary. In the years in which a formal review is not conducted, the Board has tasked management with reviewing the charters and recommending any changes management deems necessary or reflective of good corporate governance. The charters are also changed as needed to comply with any corresponding changes to any applicable rule or regulation.

2018 Proxy Statement |![]() 13

13

Information About Our Board and Corporate Governance |

All of our committees are comprised of independent directors who meet the independence requirements of the New York Stock Exchange ("NYSE") rules, SEC rules, and the Company's Director Independence Standards, including any specific committee independence requirements. The duties and responsibilities of our committees are as follows:

| AUDIT COMMITTEE | ||||

| Number of Meetings in 2017: 6 | ||||

RESPONSIBILITIES: | COMMITTEE MEMBERS: | |||

The Audit Committee: • Oversees the integrity of the Company's financial statements and internal controls; • Appoints the independent accountants and is responsible for their qualifications, independence, performance (including resolution of disagreements between the independent accountants and management regarding financial reporting), and compensation; • Participates in the selection of the independent accountants' new lead engagement partner each time a mandatory rotation occurs; • Monitors the Company's compliance with legal and regulatory requirements; • Sets policies for hiring employees or former employees of the independent accountants; • Reviews the annual audited financial statements or quarterly financial statements, as applicable, and the "Management's Discussion and Analysis of Financial Condition and Results of Operations" contained therein; | • Bruce J. Nordstrom, Chair • Denis A. Cortese • Richard P. Fox • Dale E. Klein • Humberto S. Lopez • David P. Wagener "The audit function is critical -Bruce Nordstrom | |||

• Discusses with management and the independent accountants significant financial reporting issues and judgments made in connection with the preparation of the Company's financial statements; • Reviews the Company's draft earnings press releases, as well as financial information and earnings guidance provided to analysts and rating agencies; • Discusses guidelines and policies to govern the process by which risk assessment and risk management is undertaken across the Company and periodically reviews the principal risks related to the Company's financial statements, audit functions and other major financial risk exposures; and • Reviews management's monitoring of the Company's compliance with the Company's Code of Ethics and Business Practices. The Board has determined that each member of the Audit Committee meets the NYSE experience requirements and that Mr. Nordstrom, the Chair of the Audit Committee, and Mr. Fox are "audit committee financial experts" under applicable SEC rules. None of the members of our Audit Committee, other than Mr. Fox, currently serve on more than three public company audit committees. Mr. Fox currently serves on the audit committees of four public companies, including Pinnacle West. Our Board has discussed with Mr. Fox the time and effort required to be devoted by Mr. Fox to his service on these committees and has affirmatively determined that such services do not impair Mr. Fox's ability to serve as an effective member of our Audit Committee. | ||||

| | | | | |

14![]() | 2018 Proxy Statement

| 2018 Proxy Statement

| Information About Our Board and Corporate Governance |

| CORPORATE GOVERNANCE COMMITTEE | ||||

| Number of Meetings in 2017: 5 | ||||

RESPONSIBILITIES: | COMMITTEE MEMBERS: | |||

The Corporate Governance Committee: • Reviews and assesses the Corporate Governance Guidelines; • Develops and recommends to the Board criteria for selecting new directors; • Identifies and evaluates individuals qualified to become members of the Board, consistent with the criteria for selecting new directors; • Recommends director nominees to the Board; • Recommends to the Board who should serve on each of the Board's committees; • Reviews the results of the Annual Meeting shareholder votes; • Reviews and makes recommendations to the Board regarding the selection of the CEO and CEO and senior management succession planning; • Reviews the Company's Code of Ethics and Business Practices for compliance with applicable law; | • Kathryn L. Munro, Chair • Michael L. Gallagher • Roy A. Herberger, Jr. • Bruce J. Nordstrom "The Corporate Governance -Kathy Munro | |||

• Recommends a process for responding to communications to the Board by shareholders and other interested parties; • Reviews the independence of members of the Board and approves or ratifies certain types of related-party transactions; • Reviews and makes recommendations to the Board regarding shareholder proposals requested for inclusion in the Company's proxy materials; • Reviews and makes recommendations regarding proxy material disclosures related to the Company's corporate governance policies and practices; • Periodically reviews the principal risks relating to the Company's corporate governance policies and practices; • Oversees the Board and committee self-assessments on at least an annual basis; and • Reviews and assesses the Company's Political Participation Policy, and then reviews the Company's policies and practices with respect to governmental affairs strategy and political activities in accordance with the Company's Political Participation Policy. The Corporate Governance Committee periodically reviews and recommends to the Board amendments to the Corporate Governance Guidelines and the Political Participation Policy. The Corporate Governance Guidelines and the Political Participation Policy are available on the Company's website (www.pinnaclewest.com). | ||||

| | | | | |

2018 Proxy Statement |![]() 15

15

Information About Our Board and Corporate Governance |

| FINANCE COMMITTEE | ||||

| Number of Meetings in 2017: 4 | ||||

RESPONSIBILITIES: | COMMITTEE MEMBERS: | |||

The Finance Committee: • Reviews the historical and projected financial performance of the Company and its subsidiaries; • Reviews the Company's financial condition, including sources of liquidity, cash flows and levels of indebtedness; • Reviews and recommends approval of corporate short-term investment and borrowing policies; • Reviews the Company's financing plan and recommends to the Board approval of the issuance of long-term debt, common equity and preferred securities, and the establishment of credit facilities; • Reviews the Company's use of guarantees and other forms of credit support; • Reviews and monitors the Company's dividend policies and proposed dividend actions; • Establishes and selects the members of the Company's Investment Management Committee to oversee the investment programs of the Company's trusts and benefit plans; | • Humberto S. Lopez, Chair • Richard P. Fox • Kathryn L. Munro • Paula J. Sims • David P. Wagener "The Finance Committee -Bert Lopez | |||

• Reviews and discusses with management the Company's process for allocating and managing capital; • Reviews and recommends approval of the Company's annual capital budget; • Reviews the Company's annual operations and maintenance budget and monitors throughout the year how the Company's actual spend tracks to the budget; • Reviews the Company's insurance programs; and • Periodically reviews the principal risks relating to the Company's policies and practices concerning budgeting, financing and credit exposures. | ||||

| | | | | |

16![]() | 2018 Proxy Statement

| 2018 Proxy Statement

| Information About Our Board and Corporate Governance |

| HUMAN RESOURCES COMMITTEE | ||||

| Number of Meetings in 2017: 7 | ||||

RESPONSIBILITIES: | COMMITTEE MEMBERS: | |||

The Human Resources Committee: • Reviews management's programs for the attraction, retention, succession, motivation and development of the Company's human resources needed to achieve corporate objectives; • Establishes the Company's executive compensation philosophy; • Recommends to the Board persons for election as officers; • Annually reviews the goals and performance of the officers of the Company and APS; • Approves corporate goals and objectives relevant to the compensation of the CEO, assesses the CEO's performance in light of these goals and objectives, and sets the CEO's compensation based on this assessment; • Makes recommendations to the Board with respect to non-CEO executive compensation and director compensation; • Acts as the "committee" under the Company's long-term incentive plans; • Reviews and discusses with management the Compensation Discussion and Analysis on executive compensation set forth in our proxy statements; | • Roy A. Herberger, Jr., Chair • Denis A. Cortese • Richard P. Fox • Humberto S. Lopez • Kathryn L. Munro "The members of the Human -Roy Herberger | |||

• Reviews the number, type, and design of the Company's pension, health, welfare and benefit plans; and • Periodically reviews the principal risks relating to the Company's compensation and human resources policies and practices. Under the Human Resources Committee's charter, the Human Resources Committee may delegate authority to subcommittees, but did not do so in 2017. Additional information on the processes and procedures of the Human Resources Committee is provided under the heading "Compensation Discussion and Analysis ("CD&A")". | ||||

| | | | | |

2018 Proxy Statement |![]() 17

17

Information About Our Board and Corporate Governance |

| NUCLEAR AND OPERATING COMMITTEE | ||||

| Number of Meetings in 2017: 4 | ||||

RESPONSIBILITIES: | COMMITTEE MEMBERS: | |||

The Nuclear and Operating Committee: • Receives regular reports from management and monitors the overall performance of Palo Verde; • Reviews the results of major Palo Verde inspections and evaluations by external oversight groups, such as the Institute of Nuclear Power Operations ("INPO") and the Nuclear Regulatory Commission ("NRC"); • Monitors overall performance of the principal non-nuclear business functions of the Company and APS, including fossil energy generation, energy transmission and delivery, customer service, fuel supply and transportation, safety, legal compliance, and any significant incidents or events; • Reviews regular reports from management concerning the environmental, health and safety ("EH&S") policies and practices of the Company, and monitors compliance by the Company with such policies and applicable laws and regulations; • Reviews APS's planning for generation resources additions and significant expansions of its bulk transmission system; • Periodically reviews the principal risks related to the Company's nuclear, fossil generation, transmission and distribution, and EH&S operations; | • Michael L. Gallagher, Chair • Denis A. Cortese • Dale E. Klein • Bruce J. Nordstrom • Paula J. Sims • David P. Wagener "In managing the oversight of -Mike Gallagher | |||

• Receives reports on the Company's sustainability initiatives and strategy; • Provides oversight of security policies, programs and controls for protection of cyber and physical assets. In addition, the Nuclear and Operating Committee receives regular reports from the Off-Site Safety Review Committee (the "OSRC"). The OSRC provides independent assessments of the safe and reliable operations of Palo Verde. The OSRC is comprised of non-employee individuals with senior management experience in the nuclear industry and the Palo Verde Director of Nuclear Assurance. | ||||

| | | | | |

18![]() | 2018 Proxy Statement

| 2018 Proxy Statement

| Information About Our Board and Corporate Governance |

The Board's Leadership Structure |

Lead Director. Kathryn L. Munro serves as the Company's Lead Director and chairs the Corporate Governance Committee. The Lead Director performs the following duties and responsibilities as set forth in our Corporate Governance Guidelines:

These duties and responsibilities do not, however, fully capture Ms. Munro's active role in serving as our Lead Director. For example, Ms. Munro has regular discussions with the CEO, other members of the senior management team and members of the Board between Board meetings on a variety of topics, and she serves as a liaison between the CEO and the independent directors. Ms. Munro focuses the Board on key issues facing our Company and on topics of interest to the Board. She takes the lead on director recruitment and has a formal annual call with each non-employee director to discuss the Board, its functions, its membership, the individual's plan with respect to his or her continuing Board service, and any other topic the individual desires to discuss with our Lead Director. Her leadership fosters a Board culture of open discussion and deliberation to support sound decision-making. She also encourages communication between management and the Board to facilitate productive working relationships.

Chairman and CEO Positions. The Chairman is Donald E. Brandt, the Company's President and CEO. The independent directors believe that Mr. Brandt, as an experienced leader with extensive knowledge of the Company and our industry, serves as a highly effective conduit between the Board and management and that Mr. Brandt provides the vision and leadership to execute on the Company's strategy and create shareholder value. The Board believes that separating the roles of the CEO and Chairman and appointing an independent Board Chairman at this time would create an additional level of unneeded hierarchy that would only duplicate the activities already being vigorously carried out by our Lead Director.

2018 Proxy Statement |![]() 19

19

Information About Our Board and Corporate Governance |

Succession Planning and Board Evaluations |

Management Succession. Our Board places a high priority on senior management development and succession planning. While the Corporate Governance Committee has principal responsibility for overseeing CEO and other senior management succession planning, the full Board is actively involved in reviewing our senior management succession plans that will allow for smooth and thoughtful leadership transitions in the future.

Executive succession planning and senior management development were specific areas of focus for the Corporate Governance Committee in 2017. The Corporate Governance Committee engaged in thorough and thoughtful discussions regarding the development and evaluation of current and potential senior leaders, as well as the development of executive succession plans, including succession plans for our CEO position.

Board Succession. Our Board has developed a robust process to refresh the Board and its leadership significantly over the next several years and beyond. The process is designed to continue to provide for a well-qualified, diverse and highly independent Board, with the requisite experience and skills to provide effective oversight. This process includes the identification of the current key skills and experience possessed by our members. A matrix of current key skills and experience possessed by our Board is on page 5 of this Proxy Statement. The identification of these skills and experiences, combined with a comprehensive Board evaluation process, provide visibility into the skills and experience leaving our Board in the future and allows for the identification of additional skills, experience or expertise needed to facilitate the Company's long-term strategy. This information is taken into account when identifying director nominees during the recruitment process.

Board Evaluations. The Corporate Governance Committee has established a thorough evaluation process wherein each Director completes a Board evaluation as well as an individual self-evaluation annually. The Board evaluation allows each Director the opportunity to examine and evaluate the Board's composition and effectiveness, competency, accountability, deliberations and administration, and each committee, as well as the opportunity to identify any skills, experience or expertise the Director believes should be represented, or more fully represented, on the Board. The individual self-evaluation asks each Director to evaluate different areas of their performance as a Director, including independence, expertise, judgment and skills. The Board assessment results are reviewed both on a one-year standalone basis and on a three-year basis in order to identify any year-over-year trends. The assessment results are initially reviewed by the Lead Director. The Lead Director then has a formal annual call with each Director to discuss the Board, its functions, its membership, the individual's plan with respect to his or her continuing Board service, and any other topic the individual desires to discuss with our Lead Director. The results of the evaluations and calls are presented to the Corporate Governance Committee and full Board each February. This process provides the Board the ability to assess the overall functioning of the Board as a whole, and identify any skills, experience or expertise needed to continue to provide effective oversight of the Company's long-term strategy.

20![]() | 2018 Proxy Statement

| 2018 Proxy Statement

| Information About Our Board and Corporate Governance |

The Board's Role in Risk Oversight |

| Top risks discussed by the Board and its committees in 2017 included cybersecurity, data privacy and ownership, physical security, and utility regulation. The Board believes it is important to look at the list fresh each year as part of a diligent risk review. | Responsibility for the management of the Company's risks rests with the Company's senior management team. The Board's oversight of the Company's risk management function is designed to provide assurance that the Company's risk management processes are well adapted to and consistent with the Company's business and strategy, and are functioning as intended. The Board focuses on fostering a culture of risk awareness and risk-adjusted decision-making and ensuring that an appropriate "tone at the top" is established. The Board regularly discusses and updates a listing of areas of risk and a suggested allocation of responsibilities for such risks among the Board and the Board committees. The charter for each of our committees requires each committee to periodically review risks in their respective areas. Each committee: • Receives periodic presentations from management about its assigned risk areas; • Receives information about the effectiveness of the risk identification and mitigation measures being employed; and • Discusses their risk reviews with the Board at least annually. |

Consistent with the requirements of the NYSE's corporate governance standards, the Audit Committee periodically reviews the Company's major financial risk exposures and the steps management has taken to monitor and control such exposures. The Audit Committee also reviews the comprehensiveness of the Board's risk oversight activities and the Company's risk assessment process, and plays a coordinating role designed to ensure that no gaps exist in the coverage by the Board committees of risk areas.

The Executive Risk Committee is comprised of senior level officers of the Company and is chaired by the Chief Financial Officer. Among other responsibilities, this Committee is responsible for ensuring that the Board receives timely information concerning the Company's material risks and risk management processes. The Executive Risk Committee provides the Board with a list of the Company's top risks on an annual basis. The internal enterprise risk management group reports to the Vice President, Controller and Chief Accounting Officer, who reports to the Executive Vice President and Chief Financial Officer. The internal risk management group is responsible for (1) implementing a consistent risk management framework and reporting process across the Company, and (2) ensuring that the Executive Risk Committee is informed of those processes and regularly apprised of existing material risks and the emergence of additional material risks.

2018 Proxy Statement |![]() 21

21

Information About Our Board and Corporate Governance |

Director Resignation Policies |

| We employ a plurality voting standard with a director resignation policy because we believe a majority voting policy is inconsistent with cumulative voting, which is mandated by the Arizona Constitution. | With respect to the election of directors, the Company's Bylaws provide that in an uncontested election, a director nominee who receives a greater number of votes cast "withheld" for his or her election than "for" such election will promptly tender his or her resignation to the Corporate Governance Committee. The Corporate Governance Committee is required to evaluate the resignation, taking into account the best interests of the Company and its shareholders, and will recommend to the Board whether to accept or reject the resignation. |

Under the Company's Corporate Governance Guidelines, upon a substantial change in a director's primary business position from the position the director held when originally elected to the Board, a director is required to apprise the Corporate Governance Committee and to offer his or her resignation for consideration to the Corporate Governance Committee. The Corporate Governance Committee will recommend to the Board the action, if any, to be taken with respect to the tendered resignation.

Director Retirement Policy |

Under the Company's Corporate Governance Guidelines, an individual shall not be eligible to be nominated for election or re-election as a member of the Board of the Company or APS if, at the time of the nomination, the individual has attained the age of 75 years. This policy shall apply regardless of the source of the nomination or whether the nomination was made at a meeting of the Board of Directors, at an Annual Meeting or otherwise.

22![]() | 2018 Proxy Statement

| 2018 Proxy Statement

| Information About Our Board and Corporate Governance |

Shareholder Engagement and Communications with the Board |

Our Goal. What our shareholders think is important to us. We seek to maintain a transparent and productive dialogue with our shareholders by:

Our Plan. To accomplish this goal, we have an established shareholder engagement program designed to maintain a dialogue with our shareholders, which was further augmented during 2017 in response to what the Board considered a disappointing level of shareholder support for our annual advisory vote on compensation. Each year we strive to respond to shareholder questions in a timely manner, conduct extensive proactive outreach to investors, and evaluate the information we provide to investors in an effort to continuously improve our engagement. In 2017, we contacted the holders of approximately 50% of the shares outstanding and met with the holders of approximately 40% of the shares outstanding. Our Lead Director and member of the Human Resources Committee, Kathryn Munro, participated in a number of the shareholder discussions providing shareholders with direct access to the Board.

Our Results. We listened to our shareholders. After considering their feedback, the Board in late 2017 and early 2018 made several changes in response:

2018 Proxy Statement |![]() 23

23

Information About Our Board and Corporate Governance |

Communicating with the Board. Shareholders and other parties interested in communicating with the Board may do so by writing to the Corporate Secretary, Pinnacle West Capital Corporation, 400 North Fifth Street, Mail Station 8602, Phoenix, Arizona 85004. The Corporate Secretary will transmit such communications, as appropriate, depending on the facts and circumstances outlined in the communications. In that regard, the Corporate Secretary has discretion to exclude communications that are unrelated to the duties and responsibilities of the Board, such as commercial advertisements or other forms of solicitations, service or billing matters and complaints related to individual employment-related actions.

Codes of Ethics and APS Core Strategic Framework |

To ensure the highest levels of business ethics, the Board has adopted the Code of Ethics and Business Practices, which applies to all employees, officers and directors, and the Code of Ethics for Financial Executives, both of which are described below:

Code of Ethics and Business Practices ("Code of Ethics"). Employees, directors and officers receive access to and training on the Code of Ethics when they join the Company or APS, as well as annual updates. The Code of Ethics helps ensure that employees, directors and officers of the Company and APS act with integrity and avoid any real or perceived violation of the Company's policies and applicable laws and regulations. The Company provides annual online training and examination covering the principles in the Code of Ethics. This training includes extensive discussion of the Company's values, an explanation of Company ethical standards, application of ethical standards in typical workplace scenarios, information on reporting concerns, assessment questions to measure understanding, and an agreement to abide by the Code of Ethics. All employees of the Company and APS and all of our directors complete the training.

Code of Ethics for Financial Executives. The Company has adopted a Code of Ethics for Financial Executives, which is designed to promote honest and ethical conduct and compliance with applicable laws and regulations, particularly as related to the maintenance of financial records, the preparation of financial statements, and proper public disclosure. "Financial Executive" means the Company's CEO, Chief Financial Officer, Chief Accounting Officer, Controller, Treasurer, General Counsel, the President and Chief Operating Officer of APS, and other persons designated from time to time as a Financial Executive subject to the Code of Ethics for Financial Executives by the Chair of the Audit Committee.

Both codes are available on the Company's website(www.pinnaclewest.com).

24![]() | 2018 Proxy Statement

| 2018 Proxy Statement

| Information About Our Board and Corporate Governance |

Core. The Company and APS have adopted Core, which is a strategic framework that sets forth the foundation from which we operate. It defines our vision, mission, critical areas of focus, and values. APS's vision is to create a sustainable energy future for Arizona. APS's mission is to safely and efficiently deliver reliable energy to meet the changing needs of our customers. The critical areas of focus are employees, operational excellence, security, environment, customer value, community, and shareholder value. The framework affirms our corporate values of safety, integrity and trust, respect and inclusion, and accountability. Here is our Core:

2018 Proxy Statement |![]() 25

25

Information About Our Board and Corporate Governance |

Director Qualifications and Selection of Nominees for the Board |

Director Qualifications. The Bylaws and the Corporate Governance Guidelines contain Board membership criteria that apply to nominees recommended for a position on the Board. Under the Bylaws, a director must be a shareholder of the Company. In determining whether an individual should be considered for Board membership, the Corporate Governance Committee considers the following core characteristics:

The Corporate Governance Committee considers diversity in its selection of nominees utilizing a broad meaning to include not only factors such as race and gender, but also background, experience, skills, accomplishments, financial expertise, professional interests, and the potential contribution of each candidate to the diversity of backgrounds, experience and competencies which the Board desires to have represented. The Corporate Governance Committee considers the following qualities as well:

26![]() | 2018 Proxy Statement

| 2018 Proxy Statement

| Information About Our Board and Corporate Governance |

States. As we plan for our future, Palo Verde plays a large role in shaping the Company's business strategy and the future of our generation mix.

Selection of Nominees for the Board. The Corporate Governance Committee uses a variety of methods to identify and evaluate nominees for a director position. The Corporate Governance Committee regularly assesses the appropriate size of the Board, whether any vacancies on the Board are expected due to retirement or otherwise, and whether the Board reflects the appropriate balance of knowledge, skills, expertise, and diversity required for the Board as a whole. In the event that vacancies are anticipated, or otherwise arise, the Corporate Governance Committee may consider various potential candidates. Candidates may be considered at any point during the year and come to the attention of the Corporate Governance Committee through current Board members, professional search firms or shareholders. The Corporate Governance Committee evaluates all nominees from these sources against the same criteria.

2018 Proxy Statement |![]() 27

27

| Proposal 1 — Election of Directors |

The ten nominees for election as directors are set forth below. All nominees will be elected for a one-year term that will expire at the 2019 Annual Meeting. The directors' ages are as of February 21, 2018. All of our directors also serve as directors of APS for no additional compensation.

| | | |

| Donald E. Brandt | | BACKGROUND |

Age 63 Director since 2009 Chairman of the Board, President and CEO of the Company and APS Mr. Brandt not only serves as our Chairman of the Board, President and CEO, he has been recognized as a leader in the industry, currently serving as Chairman of Nuclear Energy Institute ("NEI") and a Board Member of the Institute of Nuclear Power Operations ("INPO"), Nuclear Energy Insurance Limited ("NEIL") and Edison Electric Institute ("EEI"). Mr. Brandt brings the following key attributes to the Company: • Business strategy experience • CEO/senior leadership experience • Complex operations experience • Extensive knowledge of the Company's business environment • Government/public policy/regulatory knowledge • Nuclear experience • Utility industry experience | | Mr. Brandt has been Chairman of the Board and CEO of the Company since April 2009 and President of the Company since March 2008. He has been President of APS since May 2013, Chairman of the Board of APS since April 2009, and CEO of APS since March 2008. Mr. Brandt also served as President of APS from December 2006 to January 2009. Mr. Brandt has served as an officer of the Company in the following additional capacities: March 2008 to April 2009 as Chief Operating Officer; September 2003 to March 2008 as Executive Vice President; December 2002 to September 2003 as Senior Vice President; and December 2002 to March 2008 as Chief Financial Officer. QUALIFICATIONS As Chairman of the Board, President and CEO of the Company and APS, Mr. Brandt has hands-on experience in leading a large, complex organization. This leadership, combined with nearly three decades of leadership experience in the utility industry, gives Mr. Brandt extensive knowledge of the factors affecting the Company's business environment and business strategy, including utility-specific financial and operational experience and public policy and regulatory knowledge. Mr. Brandt also has strategic nuclear expertise and currently serves as Chairman of NEI and as a Board Member of INPO, NEIL and EEI, all major industry organizations that provide insight into nuclear, operational, financial and policy matters of great importance to the Company. |

| | | |

28![]() | 2018 Proxy Statement

| 2018 Proxy Statement

| Proposal 1 — Election of Directors |

| | | |

| Denis A. Cortese, M.D. | | BACKGROUND |

Age 73 Director since 2010 Committees • Audit • Human Resources • Nuclear and Operating INDEPENDENT DIRECTOR Dr. Cortese, former President and CEO of Mayo Clinic, a worldwide leader in medical care with operations located throughout the United States, brings the following key attributes to the Company: • Complex operations experience • Customer perspectives • Finance/capital allocation • Financial literacy/accounting • Government/public policy/regulatory • Human resources management/compensation • Risk oversight and management | | Dr. Cortese is the Director of the ASU Health Care Delivery and Policy Program and a Foundation Professor in the Department of Biomedical Informatics, Ira A. Fulton School of Engineering and in the School of Health Management and Policy, W.P. Carey School of Business. He has held these positions since February 2010. Dr. Cortese has been Emeritus President and Chief Executive Officer of the Mayo Clinic (medical clinic and hospital services) since November 2009, and was President and Chief Executive Officer of the Mayo Clinic from March 2003 until his retirement in November 2009. Dr. Cortese is also a director of Cerner Corporation. QUALIFICATIONS As former President and Chief Executive Officer of the Mayo Clinic, a multi-state, complex hospital and medical care system, Dr. Cortese gained extensive experience in human resources management, risk oversight and risk management, customer perspectives, and leading complex organizations with multiple constituencies. He led an organization that delivers strong and efficient customer service, which parallels the Company's strategies. Through his service at Mayo, he developed experience in finance, capital allocation, accounting, and regulation, and his background in public policy development, science and technology brings valuable perspective to issues that face the Company. |

| | | |

2018 Proxy Statement |![]() 29

29

Proposal 1 — Election of Directors |

| | | |

| Richard P. Fox | | BACKGROUND |